Hair today

Date: 2015-10-07; view: 589.

The purchase of Gillette follows two other big acquisitions since Mr Lafley took the top job at P&G. In November 2001 he bought Clairol, a hair-dye company, for $5 billion. Two years later, he spent $6.9 billion on Wella, a German beauty firm. Less noticed, but perhaps more important to P&G's rejuvenation, has been Mr Lafley's willingness to jettison tired brands.

As David Harding of Bain, a consultancy, points out, consumer-goods firms find it hard to boost growth by letting go of older, slower-growing brands. These brands have become so established in the minds of shoppers that they sell themselves, points out Mr Harding—customers buy them without thinking. That makes them a good source of profits. But they also eat up scarce management time and marketing talent on lines of business that are unlikely ever to grow much. At P&G, Mr Lafley has shed Punica, a German juice brand and Sunny Delight, an American one, Jif (peanut butter) and Crisco (pastry shortening). He has also got rid of P&G's BIZ, Milton, Sanso, Rei and Oxydol detergent brands. (The Oxydol sale must have especially hurt sentimental Proctoids: the soap powder was the proud sponsor in 1933 of “Ma Perkins”, one of America's first soap operas.)

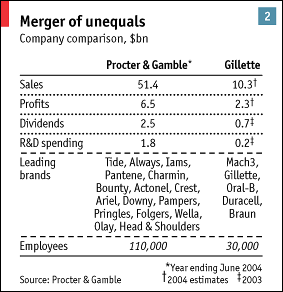

The combined effect of these sales and purchases has been two-fold. First, Mr Lafley has given P&G's portfolio of brands a sharper focus on beauty and grooming products, where he spots more potential for growth. Second, by reinvesting cash from P&G's sales back into its strongest brands, Mr Lafley has bet more of the firm's resources on a smaller number of top “superbrands”, which are contributing more and more to the company's overall sales. In 2000, P&G owned ten brands each with annual sales of more than $1 billion. By 2004, it had 16 brands with sales over $1 billion. Together these earned the firm $30 billion of its $51.4 billion of sales that year. The purchase of Gillette, where Mr Kilts has followed a similar strategy, adds a further five superbrands. “P&G has done really well consolidating its brands down to a strong core,” says Uta Werner of Marakon Associates, a consultancy.

P&G is hoping that this growing stable of superbrands will help it to weather the industry's tough environment. Competition for the modern consumer's attention is ferocious. Steven Fredericks, the chief executive of TNS Media Intelligence, says that he adds an astonishing 400-700 new brands every day to the 2.1m brands that his New York company already tracks. These can range from a new face cream to a new model of car, or a film (which is now considered a brand). Advertising executives in Japan reckon the number of new beverages that enter the market each year runs into the thousands. Most perish almost instantly in the relentless battle for scarce shelf-space in Japan's small shops.

The superbrands should also help P&G to focus research and development spending on the most promising products. Like Gillette, P&G prides itself on its skill in adding incremental innovations to seemingly mature products, and then persuading customers to part with more money for them. Over the years, King Gillette's safety razor has added more blades, a lubricating strip, a high-tech handle and (triumphantly, last year) an exorbitantly-priced battery-powered version featuring “micro-pulse technology”.

P&G, meanwhile, has turned the humble floor mop into a “swiffer”, an “all-in-one, ready-to-use mopping system” that features an “action sprayer”, “premixed cleaning solution” and super-absorbent, triple-layer cleaning pads. Together, the two firms hope to transform yet more mundane household goods into technology-rich marvels. Since research suggests that the average supermarket shopper spends just a few seconds pondering each purchase and is unlikely to know the price of most items, P&G's and Gillette's push towards the frontiers of household-goods technology could prove profitable.

Another trumpeted benefit of the merger is the access Gillette will win to P&G's more evolved distribution network in developing countries, where the potential growth rate for the industry's products remains higher than in America, Europe or Japan. As the world's fastest-growing big market for consumer-goods firms, China will be critical to the success of the merger. P&G's long experience there should help it to push Gillette's lesser-known brands to the mainland's rising middle classes.

| <== previous lecture | | | next lecture ==> |

| The Rise of the Super brands | | | Chinese lessons |